At the July 13th, 2022 Regular Council Meeting, Council adopted the Development Charges By-law. Development Charges will come into effect beginning September 15, 2022.

The Development Charges By-law can be read in its entirety below.

Development Charges Information Pamphlet

Development Charges By-law # 2022-057 (5.1) - Indexing - Development charges imposed pursuant to this By-law shall be adjusted annually, without amendment to this By-law, on January 1“, in accordance with the prescribed index in the Act.

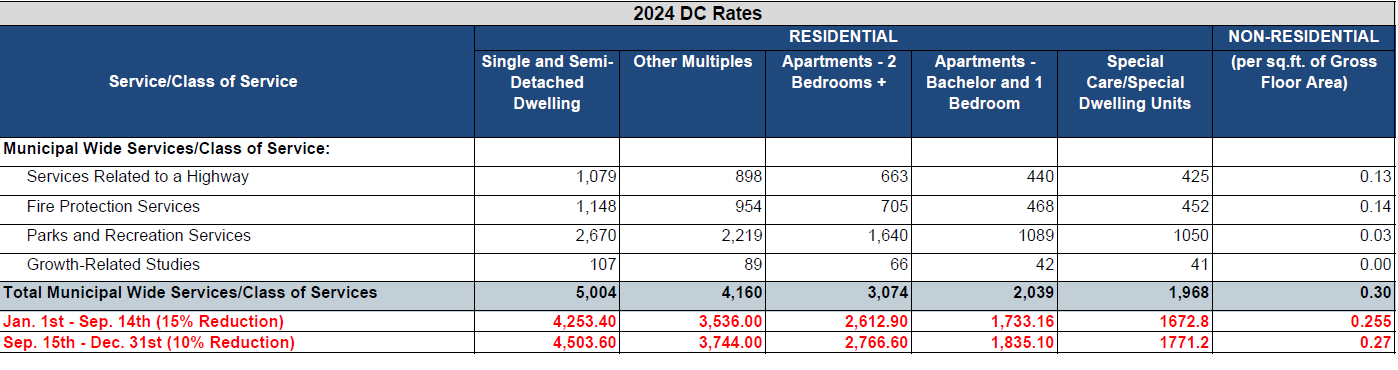

Development Charges - 2024 Indexed Rates (15% Rebate / Bill 23 Tiered Reduction, September 15, 2023 Update) i.e. Single Detached Dwelling $5,004 - $750.60 (15%) = $4,253.40 (Payable Rate at Time of Building Permit Issuance)

The Township of South Stormont has retained consultants Watson & Associates Economists Ltd. to undertake a Development Charges Background Study, as prescribed by the Development Charges Act 1997.

The complete background study, which can be downloaded below, addresses the forecasted amount, type, and location of growth for the community, the requirement for "rules" governing the imposition of development charges, and provide sufficient background information on the legislation, recommendations and the basis for these recommendations.

The Watson & Associates team has had a number of meetings with Township Council and Staff and have undertaken significant data collection exercises to arrive at their conclusions and present their recommendations.

A Public Meeting will be scheduled to receive public commentary on the Development Charges Background Study and proposed implementation of a new Development Charges By-law.

Development Charges Background Study

| Process Steps | Dates |

|---|---|

| Project initiation meeting with Township Staff | November 2020 |

| Data collection and staff interviews | November 2020 - December 2021 |

| Presentation of draft findings and Development Charges policy discussion with Township Staff | January 20, 2022 |

| Presentation of DRAFT Development Charges Background Study to Committee of the Whole | February 7, 2022 |

| Presentation of DRAFT Development Charges Background Study to Council | February 16, 2022 |

| Development Charges Background Study and Draft Development Charges By-law available to public | May 5, 2022 |

| Public Stakeholder Meeting |

May 30, 2022 (Council Chambers) |

| Public Meeting of Council |

June 8, 2022 (During Regular Council Meeting) |

| Development Charges By-law passage |

July 13, 2022 |

| Newspaper notice given of by-law passage | By 20 days after passage |

| Last day for by-law appeal | August 22, 2022 |

| Development Charges By-law Implementation | September 15, 2022 |

| Township makes available Development Charges information pamphlet |

By 60 days after in force date.

|

| What are Development Charges? |

|

Municipalities in Ontario use Development Charges (DCs) to recover growth related capital costs associated with residential and non-residential growth. In accordance with the Development Charges Act, 1997, DCs are collected at the building permit stage to help the Town pay for the capital related costs of municipal services needed to support the new development. These services include, roads, storm water, fire emergency services, roads, parks, recreation, libraries and by-law enforcement. |

| When are Development Charges applied? |

Under the Development Charges Act, 1997 (DCA) section 2, development charges are charged for development that requires approval under the:

The DCA has also specified that the following development does not incur development charges.

Development charges are also not applicable to interior renovation building permits unless the renovation is for the purpose of a change of use (between development types) or additional non-residential gross floor area is added. |